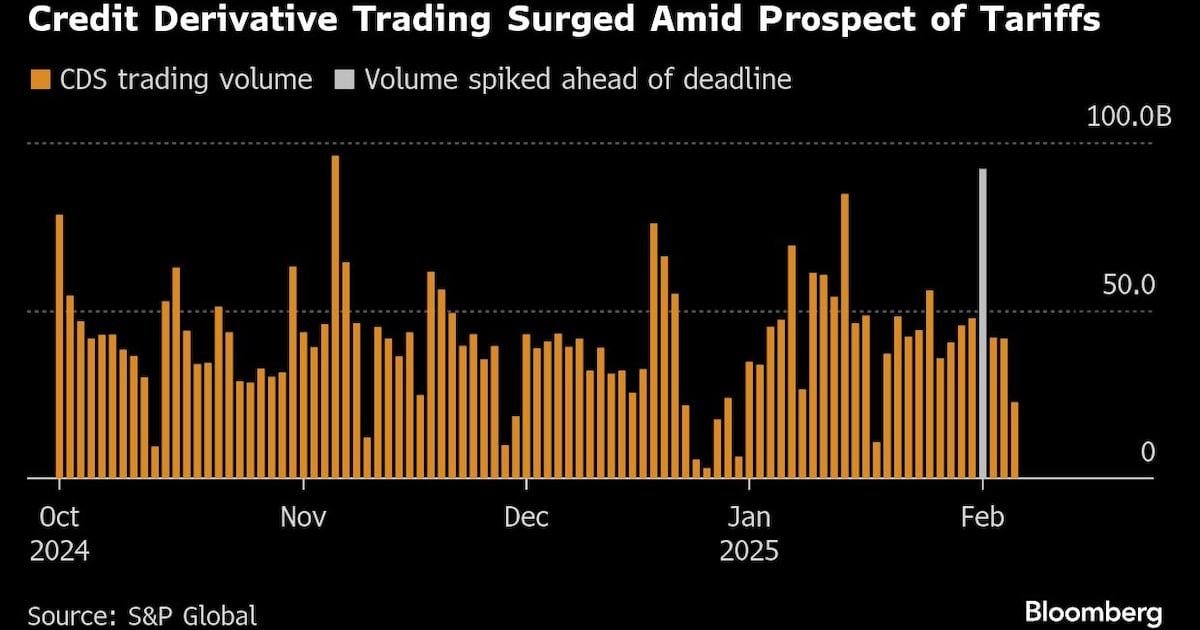

Despite President Trump’s tariff threats on Mexican and Canadian goods, credit markets remained largely unaffected, suggesting market complacency. Credit default swap (CDS) prices showed little movement, even as trading volumes surged. Analysts warn of potential risks, citing stretched valuations and a market overly relaxed about economic threats. Some strategists, like Gabriele Foa from Algebris Investments, express caution, noting the market is “priced for perfection” despite looming volatility. Meanwhile, trading in foreign-exchange options has increased as investors seek protection. As investors weigh their options, many are focusing on interest income rather than anticipating further tightening of spreads.