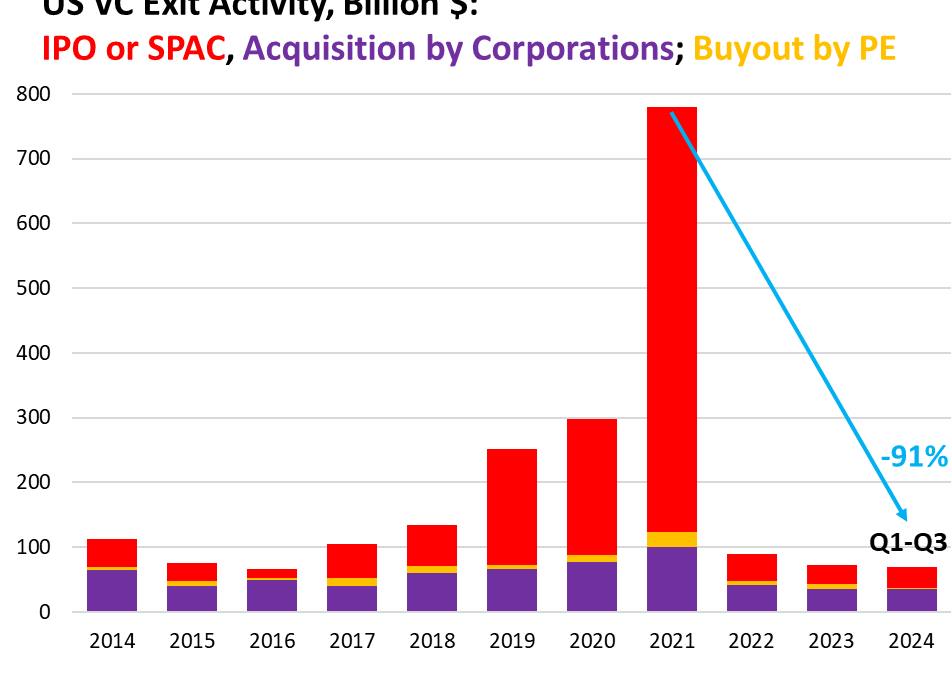

The venture capital landscape has shifted dramatically post-pandemic, with a significant drop in successful exits and a rise in “zombie VCs”—funds that no longer attract new investments but continue to charge fees. In Q3, VC exits plummeted to $10 billion, a 91% decline from 2021. The tightening market has left many startups without funding, leading to a record inventory of nearly 58,000 private companies. Active venture investors have decreased by 55%, with many unable to raise new funds. The industry is now pressuring the Federal Reserve for further rate cuts to stimulate the exit pipeline and attract investments again.