What You Should Know:

Healthcare Growth Partners (HGP) and Eliciting Insights conducted the 2024 Health IT Private Equity Survey to assess the current market dynamics amidst economic fluctuations and the upcoming U.S. presidential election. The survey captured insights from private equity investment professionals across healthcare sectors.

Key Themes & Insights

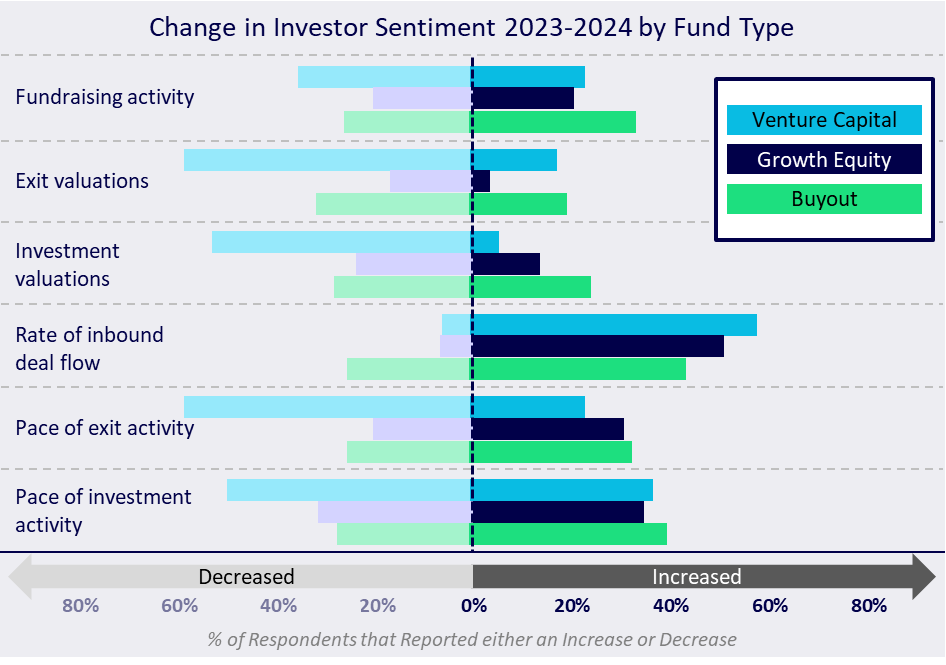

- Valuations and Activity: Valuations have declined, yet investment activity has increased, with buyout funds showing resilience.

- Profitability vs. Growth: Investors are focusing on profitability, though venture capitalists worry about neglecting growth.

- Health IT Investing: Growth equity and buyout investors remain optimistic about Health IT, despite venture capitalists’ concerns.

- AI and Technology: AI is emphasized as a tool to improve operations.

- Market Conditions: Investors are largely unfazed by the IPO slowdown and rising interest rates.

- Election Sentiment: Many believe a Trump presidency would favor private equity and healthcare investments.

Additional Observations

- Growth equity is recovering alongside buyout funds, indicating resilience.

- Structured deals are becoming more common in a buyer-friendly market.

- Most investors are unconcerned about debt burdens due to conservative practices.

- Views on remote work are mixed, highlighting productivity benefits and cultural challenges.

Overall, while uncertainty exists in venture capital, the survey reflects a resilient market adapting to new economic conditions and technological advancements.