Overview of Recent Transaction

On November 11, 2024, Saba Capital Management, L.P. acquired 142,426 shares of BlackRock Innovation & Growth Trust (BIGZ), boosting its total holdings to 57,417,734 shares at $7.75 each. This investment indicates a strong commitment to BIGZ, now comprising 7.41% of Saba’s portfolio.

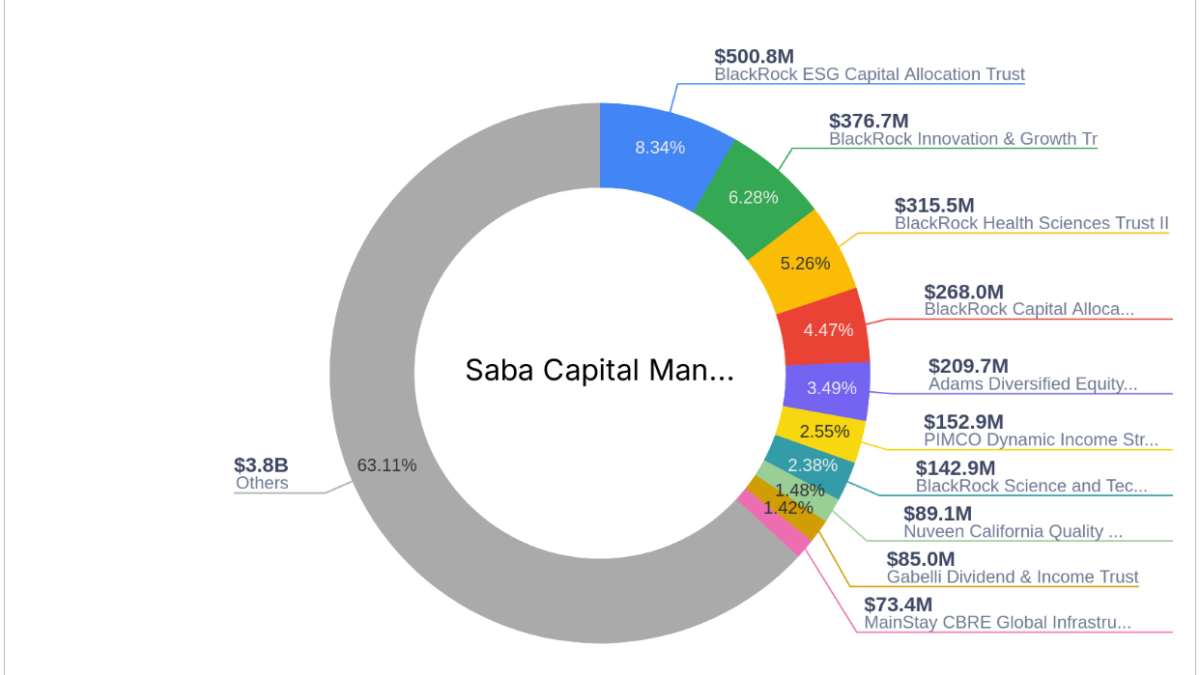

Profile of Saba Capital Management, L.P.

Located in New York, Saba Capital focuses on value investing, particularly in closed-end funds and undervalued assets, managing a $6 billion portfolio.

Impact of the Trade on Saba Capital’s Portfolio

The acquisition increased BIGZ’s impact on Saba’s portfolio to 0.02%, with Saba owning 26.24% of total BIGZ shares.

Insight into BlackRock Innovation & Growth Trust

BIGZ, a closed-end fund, targets mid to small-cap growth companies and has a market cap of $1.7 billion.

Financial Health and Stock Performance

BIGZ has experienced negative returns, with a -3.26% ROE, despite a year-to-date increase of 7.64%.

Market Context and Future Outlook

The trust’s performance reflects volatility, but recent gains may indicate potential recovery.

Strategic Importance of the Trade

Saba’s increased investment signals confidence in BIGZ’s innovative growth potential.

Conclusion

This transaction highlights Saba’s strategy to invest in promising growth areas, positioning itself for future market opportunities.